A) expand the business.

B) pay off debt.

C) build up the cash balance.

D) pay employees.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Major investing and financing activities that do not involve cash do not have to be reported as part of the statement of cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Two years ago,your company bought $40,000 in bonds from another company.This month,it sold half of those bonds for $20,640 and lent $1,000 to an employee with a promissory note.On the statement of cash flows for this accounting period,your company would report a net cash:

A) outflow of $19,640 from investing activities.

B) inflow of $19,640 from investing activities.

C) inflow of $20,640 from investing activities.

D) outflow of $20,640 from investing activities.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

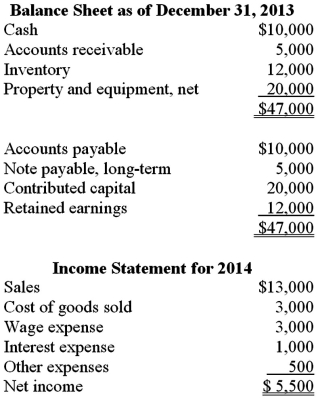

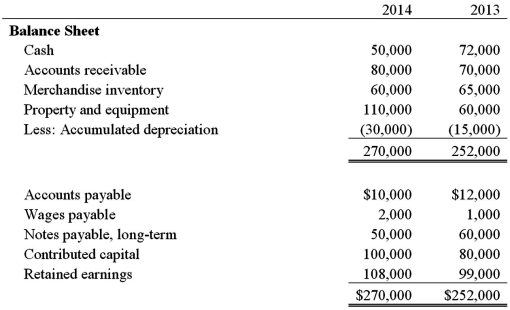

The Extra Surplus Company's Balance Sheet for December 31,2013 and the Income Statement for 2014 are shown below.  Additional Data for 2014:

Sales were $13,000;$8,000 in cash was received from customers.

Bought new land for cash,$10,000.

Sold other land for its book value of $5,000.

Paid $1,000 principal on the long-term note payable and $1,000 in interest.

Issued new shares of stock for $10,000 cash.

$1,000 of dividends were declared and paid.

Paid $5,500 on accounts payable.

No inventory purchases were made;other expenses were incurred on account.

All wages were paid in cash.

Other expenses were on account.

a.Prepare the statement of cash flows for the year ended December 31,2014 using the direct method.

b.Prepare a balance sheet at December 31,2014.

Additional Data for 2014:

Sales were $13,000;$8,000 in cash was received from customers.

Bought new land for cash,$10,000.

Sold other land for its book value of $5,000.

Paid $1,000 principal on the long-term note payable and $1,000 in interest.

Issued new shares of stock for $10,000 cash.

$1,000 of dividends were declared and paid.

Paid $5,500 on accounts payable.

No inventory purchases were made;other expenses were incurred on account.

All wages were paid in cash.

Other expenses were on account.

a.Prepare the statement of cash flows for the year ended December 31,2014 using the direct method.

b.Prepare a balance sheet at December 31,2014.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cash flows from investing activities include all of the following except:

A) a purchase of an automobile.

B) a sale of a trademark.

C) a purchase of stock of another company.

D) an issuance of bonds.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

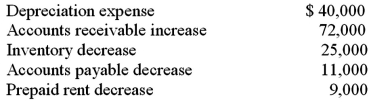

A company's income statement for the year shows a net loss of $90,000.Additional information for the year follows:  What is the net cash provided by (used in) operating activities?

What is the net cash provided by (used in) operating activities?

A) ($99,000)

B) $27,000

C) $13,000

D) ($45,000)

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What is the amount of cash paid for wages?

A) $34,000

B) $35,000

C) $36,000

D) $22,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company loaned $1,000,000 with interest at 7% to another company.The interest revenue from this loan would be reported on the statement of cash flows as

A) cash inflow from operating activities.

B) cash inflow from investing activities.

C) cash inflow from financing activities.

D) noncash transaction in a supplemental disclosure.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

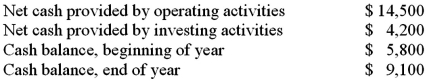

A corporation prepared its statement of cash flows for the year.The following information is taken from that statement:  What is the cash balance at the beginning of the year?

What is the cash balance at the beginning of the year?

A) $5,600

B) $2,800

C) $6,300

D) $15,400

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If selling,general and administrative expenses are $53,600,of which $12,200 is depreciation expense,and beginning prepaid expenses are $3,000,ending prepaid expenses are $5,000,beginning accrued expenses are $17,000,and ending accrued expenses are $20,000,how much cash was paid to employees and service providers?

A) $52,600

B) $40,400

C) $42,400

D) $64,800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

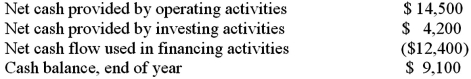

A corporation prepared its statement of cash flows for the year.The following information is taken from that statement:  What is the amount of net cash provided by (used in) financing activities?

What is the amount of net cash provided by (used in) financing activities?

A) $15,400

B) ($3,300)

C) ($15,400)

D) $3,300

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Essay

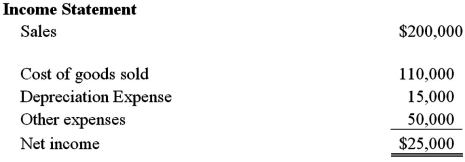

Wickersham Brothers Inc.is developing its annual financial statements at December 31,2014.The statements are complete except for the statement of cash flows.The completed comparative balance sheets and income statements are summarized.

Additional Data:

a.Bought equipment for cash,$50,000.

b.Paid $10,000 on long-term note payable.

c.Issued new shares of stock for $20,000 cash.

d.Cash dividends of $16,000 were declared and paid.

e.Accounts payable are exclusively related to inventory purchases on credit.

Prepare a schedule summarizing operating,investing,and financing cash flows using the T-account approach.

Additional Data:

a.Bought equipment for cash,$50,000.

b.Paid $10,000 on long-term note payable.

c.Issued new shares of stock for $20,000 cash.

d.Cash dividends of $16,000 were declared and paid.

e.Accounts payable are exclusively related to inventory purchases on credit.

Prepare a schedule summarizing operating,investing,and financing cash flows using the T-account approach.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the direct method is used to determine the cash flows from operating activities,which of the following adjustments must be made to income tax expense to determine total income tax payments?

A) Add all changes in income taxes and income taxes payable.

B) Add decreases in income taxes payable and subtract increases in income taxes payable.

C) Add increases in income taxes payable and subtract decreases in income taxes payable.

D) Subtract all changes in income taxes payable.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information to answer the following question.What is the amount of cash collected for rent?

A) $21,000

B) $19,000

C) $23,000

D) $14,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A company bought $250,000 of equipment with an expected life of ten years and no residual value.After six years the company sold the equipment for $94,000.If it uses straight-line depreciation and the indirect method is used to determine cash flows from operating activities,which of the following reflects how the sale of the equipment would be reported in the statement of cash flows?

A) $94,000 is recorded as a cash inflow from investing activities and no other sections of the statement are affected.

B) $94,000 is recorded as a cash inflow from investing activities and $6,000 is added to convert net income to net cash flow from operating activities.

C) $94,000 is recorded as a cash inflow from investing activities and $6,000 is subtracted to convert net income to net cash flow from operating activities.

D) $94,000 is recorded as a cash inflow from operating activities.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the following question.What is the net cash flows provided by (used in) financing activities?

A) $620,000

B) $410,000

C) $610,000

D) $490,000

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the information above to answer the question below.The company uses the indirect method in preparing the statement of cash flows.What is the amount of depreciation expense that will be reported in the operating activities section of the statement?

A) $4,000

B) $11,000

C) $7,000

D) $10,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a company's cost of goods sold is $158,000 for the period,beginning and ending inventory balances are $18,000 and $13,000,respectively,and the beginning and ending accounts payable balances are $19,000 and $7,500,respectively,the cash paid to suppliers is:

A) $157,000

B) $163,500

C) $164,500

D) $151,500

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A toy store with a calendar year-end is likely to have:

A) unpredictable fluctuations in cash flow from quarter to quarter.

B) the largest cash inflow from operations in the second and third quarters (April - September) .

C) a fairly stable cash flow across all four quarters.

D) the largest cash inflow from operations in the fourth and first quarters (October - March) .

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Using the indirect method,the increase in accumulated depreciation is added to net income in the operating section.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 140 of 147

Related Exams