B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Conversion of inputs to outputs is recorded in the

A) Work in Process Inventory account.

B) Finished Goods Inventory account.

C) Raw Material Inventory account.

D) both a and b.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A specific product cannot be a cost object.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A variable cost remains constant on a per-unit basis as production increases.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Both accountants and economists view variable costs as linear in nature.

B) False

Correct Answer

verified

False

Correct Answer

verified

Essay

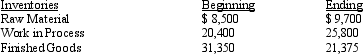

Using the information below, prepare a Schedule of Cost of Goods Manufactured (in good form) for the Ezell Company for June 20y0:

Additional information: purchases of raw material were $51,900; 21,560 direct labor hours were worked at $12.50 per hour; overhead costs were $39,800.

Additional information: purchases of raw material were $51,900; 21,560 direct labor hours were worked at $12.50 per hour; overhead costs were $39,800.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Product costs are deducted from revenue

A) as expenditures are made.

B) when production is completed.

C) as goods are sold.

D) to minimize taxable income.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Unexpired costs are reflected on the balance sheet.

B) False

Correct Answer

verified

True

Correct Answer

verified

True/False

A variable cost will be an effective cost driver.

B) False

Correct Answer

verified

Correct Answer

verified

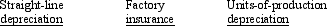

Multiple Choice

Which of the following would generally be considered a fixed factory overhead cost?

A) no no no

B) yes no yes

C) yes yes no

D) no yes no

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

The assumed range of activity that reflects the company's normal operating range is referred to as the ______________________________.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In a perpetual inventory system, the sale of items for cash consists of two entries. One entry is a debit to Cash and a credit to Sales. The other entry is a debit to

A) Work in Process Inventory and a credit to Finished Goods Inventory.

B) Finished Goods Inventory and a credit to Cost of Goods Sold.

C) Cost of Goods Sold and a credit to Finished Goods Inventory.

D) Finished Goods Inventory and a credit to Work in Process Inventory.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

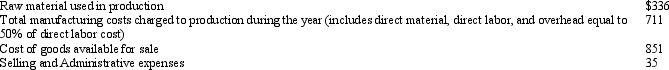

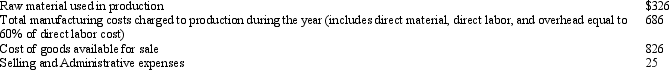

Horner Corporation The following information has been taken from the cost records of Horner Corporation for the past year:

Refer to Horner Company. Direct labor cost charged to production during the year was

Refer to Horner Company. Direct labor cost charged to production during the year was

A) $125

B) $188

C) $250

D) $375.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A predictor which has an absolute cause and effect relationship to a cost is referred to a cost driver.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

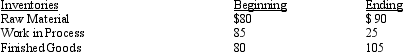

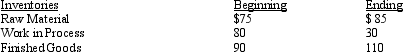

Jordan Company The following information has been taken from the cost records of Jordan Company for the past year:

Refer to Jordan Company. Cost of Goods Sold was

Refer to Jordan Company. Cost of Goods Sold was

A) $691.

B) $716.

C) $736.

D) $801.

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a service industry, direct materials are usually insignificant in amount and can not easily be traced to a cost object.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In an actual cost system, overhead is assigned to Work in Process Inventory with a debit entry to the account.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would need to be allocated to a cost object?

A) direct material

B) direct labor

C) direct production costs

D) indirect production costs

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

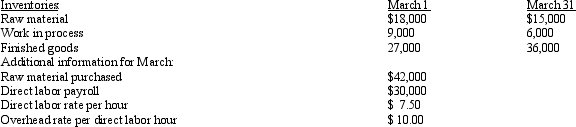

Multiple Choice

Anderson Enterprises  Refer to Anderson Enterprises. For March, conversion cost incurred was

Refer to Anderson Enterprises. For March, conversion cost incurred was

A) $30,000.

B) $40,000.

C) $70,000.

D) $72,000.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

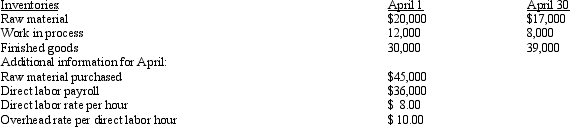

Multiple Choice

Goodwin Enterprises  Refer to Goodwin Enterprises. For April, Cost of Goods Manufactured was

Refer to Goodwin Enterprises. For April, Cost of Goods Manufactured was

A) $141,000

B) $133,000.

C) $125,000.

D) $121,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 127

Related Exams