A) $9,880 favorable

B) $9,880 unfavorable

C) $7,800 unfavorable

D) $7,800 favorable

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

St. Augustine Corporation originally budgeted for $360,000 of fixed overhead at 100% of normal production capacity. Production was budgeted to be 12,000 units. The standard hours for production were 5 hours per unit. The variable overhead rate was $3 per hour. Actual fixed overhead was $360,000, and actual variable overhead was $170,000. Actual production was 11,700 units. -The fixed factory overhead volume variance is a.$9,000 favorable b.$9,000 unfavorable c.$5,500 favorable d.$5,500 unfavorable

Correct Answer

verified

b

Correct Answer

verified

Multiple Choice

The total manufacturing cost variance consists of

A) direct materials price variance, direct labor cost variance, and fixed factory overhead volume variance

B) direct materials cost variance, direct labor rate variance, and factory overhead cost variance

C) direct materials cost variance, direct labor cost variance, and variable factory overhead controllable variance

D) direct materials cost variance, direct labor cost variance, and factory overhead cost variance

F) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

An unfavorable cost variance occurs when the standard cost exceeds the actual cost.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data relate to direct labor costs for the current period: Standard costs 7,500 hours at $11.70 Actual costs 6,000 hours at $12.00 The direct labor time variance is

A) $18,000 favorable

B) $18,000 unfavorable

C) $17,550 unfavorable

D) $17,550 favorable

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In most businesses, cost standards are established principally by accountants.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The standard costs and actual costs for factory overhead for the manufacture of 2,500 units of actual production are as follows: Standard Costs Fixed overhead (based on 10,000 hours) 3 hours per unit at $0.80 per hour Variable overhead 3 hours per unit at $2.00 per hour Actual Costs Total variable cost, $18,000 Total fixed cost, $8,000 -The total factory overhead cost variance is

A) $2,000 favorable

B) $5,000 unfavorable

C) $2,500 unfavorable

D) $5,000 favorable

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A budget performance report compares actual costs with the standard costs and reports differences for possible investigation.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data relate to direct labor costs for March: Rate: standard, $12.00; actual, $12.25 Hours: standard, 18,500; actual, 17,955 Units of production: 9,450 -Which of the following is not a reason for a direct materials quantity variance?

A) malfunctioning equipment

B) purchasing of inferior raw materials

C) increased material cost per unit

D) spoilage of materials

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data relate to direct labor costs for March: Rate: standard, $12.00; actual, $12.25 Hours: standard, 18,500; actual, 17,955 Units of production: 9,450 -The total direct labor variance is

A) $2,051.25 favorable

B) $2,051.25 unfavorable

C) $2,362.50 unfavorable

D) $2,362.50 favorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Standard costs serve as a device for measuring efficiency.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

Tippi Company produces lamps that require 2.25 standard hours per unit at a standard hourly rate of $15.00 per hour. Production of 7,700 units required 17,550 hours at an hourly rate of $15.20 per hour. What is the direct labor (a) rate variance, (b) time variance, and (c) total cost variance?

Correct Answer

verified

Correct Answer

verified

True/False

Normally, standard costs should be revised when labor rates change to incorporate new union contracts.

B) False

Correct Answer

verified

True

Correct Answer

verified

Multiple Choice

Match each of the following phrases with the term (a-e) it describes. -Actual cost > standard cost at actual volumes

A) Ideal standard

B) Normal standard

C) Budget performance report

D) Unfavorable cost variance

E) Favorable cost variance

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Financial reporting systems that are guided by the principle of exceptions focus attention on variances from standard costs.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

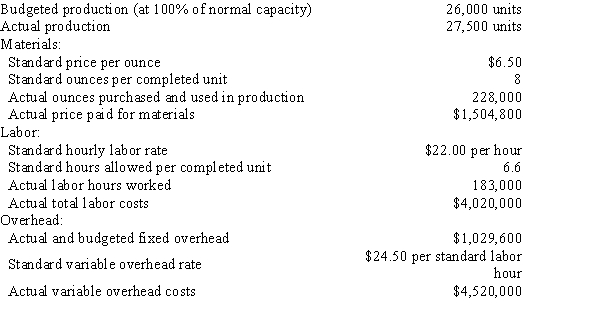

The following data are given for Zoyza Company:  Overhead is applied on standard labor hours.

-The variable factory overhead controllable variance is

Overhead is applied on standard labor hours.

-The variable factory overhead controllable variance is

A) $73,250 favorable

B) $73,250 unfavorable

C) $59,400 favorable

D) $59,400 unfavorable

F) C) and D)

Correct Answer

verified

B

Correct Answer

verified

True/False

Standards can be used in nonmanufacturing settings where the tasks are nonrepetitive in nature.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following data relate to direct labor costs for February: Actual costs 7,700 hours at $14.00 Standard costs 7,000 hours at $16.00 -The direct labor time variance is

A) $7,700 favorable

B) $7,700 unfavorable

C) $11,200 unfavorable

D) $11,200 favorable

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Ideal standards are developed under conditions that assume no idle time, no machine breakdowns, and no materials spoilage.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Match each of the following formulas and phrases with the term (a-e) it describes. -Standard variable overhead for actual units produced

A) Direct materials price variance

B) Direct labor rate variance

C) Direct labor time variance

D) Direct materials quantity variance

E) Budgeted variable factory overhead

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 172

Related Exams