A) hourly wages of assembly worker

B) straight-line depreciation on factory equipment

C) overtime wages paid to factory workers

D) the salaries for salespeople

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

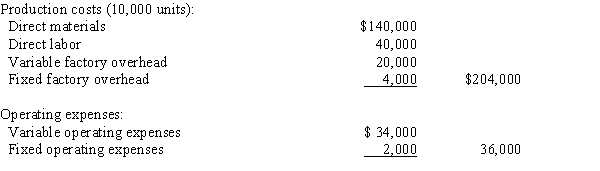

The level of inventory of a manufactured product has increased by 7,000 units during a period. The following data are also available:  The effect on operating income if absorption costing is used rather than variable costing would be a

The effect on operating income if absorption costing is used rather than variable costing would be a

A) $42,000 decrease

B) $42,000 increase

C) $52,500 increase

D) $52,500 decrease

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A business operated at 100% of capacity during its first month and incurred the following costs:  If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, the amount of operating income reported on the variable costing income statement would be

If 2,000 units remain unsold at the end of the month and sales total $300,000 for the month, the amount of operating income reported on the variable costing income statement would be

A) $100,800

B) $100,000

C) $114,800

D) $140,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Property tax expense is an example of a controllable cost for the supervisor of a manufacturing department.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following descriptions with the appropriate costing concept (a-c). -Treats fixed manufacturing cost as a period cost A)Absorption costing only B)Variable costing only C)Both absorption and variable costing

Correct Answer

verified

Correct Answer

verified

True/False

Direct labor cost is an example of a controllable cost for the supervisor of a manufacturing department.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

It would be acceptable to have the selling price of a product just above the variable costs and expenses of making and selling it in

A) the long run

B) the short run

C) both the short and long run

D) neither the short nor the long run

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The relative distribution of sales among the various products sold is referred to as the

A) by-product mix

B) joint product mix

C) profit mix

D) sales mix

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following descriptions with the appropriate costing concept (a-c). -Treats fixed selling cost as a period cost A)Absorption costing only B)Variable costing only C)Both absorption and variable costing

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of inventory at the end is smaller than that at the beginning, operating income reported under variable costing will be smaller than operating income reported under absorption costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Fixed factory overhead costs are included as part of the cost of products manufactured under the absorption costing concept.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Under variable costing, which of the following costs would not be included in finished goods inventory?

A) direct labor cost

B) direct materials cost

C) variable factory overhead cost

D) fixed factory overhead cost

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

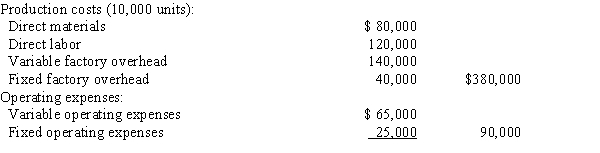

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,000 units remain unsold at the end of the month, the amount of inventory that would be reported on the absorption costing balance sheet is

If 1,000 units remain unsold at the end of the month, the amount of inventory that would be reported on the absorption costing balance sheet is

A) $38,000

B) $40,500

C) $34,000

D) $47,000

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

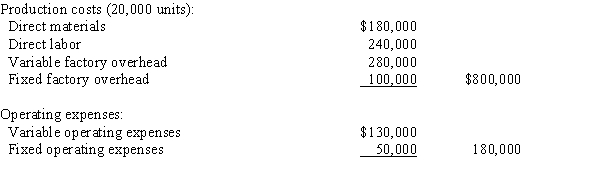

A business operated at 100% of capacity during its first month and incurred the following costs:  If 1,500 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is

If 1,500 units remain unsold at the end of the month, the amount of inventory that would be reported on the variable costing balance sheet is

A) $62,500

B) $73,500

C) $60,000

D) $52,500

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not true when determining the selling price for a product?

A) Absorption costing should be used to determine routine pricing which includes both fixed and variable costs.

B) As long as the selling price is set above the variable costs, the company will make a profit in the short run.

C) Variable costing is effective when determining short-run decisions, but absorption costing is only used for long-term pricing policies.

D) Both variable and absorption pricing plans should be considered, to include several pricing alternatives.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

In a service firm, it may be necessary to have several activity bases to properly match the change in costs with the changes in various activities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

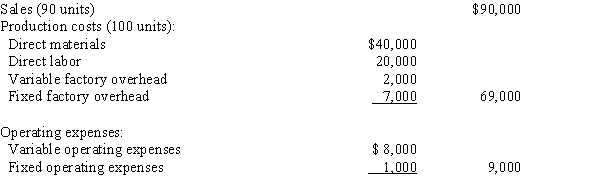

A business operated at 100% of capacity during its first month, with the following results:

-The amount of contribution margin that would be reported on the variable costing income statement is

-The amount of contribution margin that would be reported on the variable costing income statement is

A) $34,200

B) $20,200

C) $29,700

D) $26,200

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

For a period during which the quantity of product manufactured equals the quantity sold, operating income reported under absorption costing will equal the operating income reported under variable costing.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

In variable costing, the cost of products manufactured is composed of only those manufacturing costs that increase or decrease as the volume of production rises or falls.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the variable costing income statement, deduction of variable selling and administrative expenses from manufacturing margin yields

A) differential margin

B) contribution margin

C) gross profit

D) marginal expenses

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Showing 21 - 40 of 136

Related Exams