B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 10, a company issued for cash 1,500 shares of no-par common stock (with a stated value of $2) at $14, and on May 15, it issued for cash 2,000 shares of $15 par preferred stock at $58. What is the amount of paid-in capital in stated value at May 10 and paid-in capital in excess of par at May 15, assuming that the common stock is to be credited with the stated value?

A) May 10: $21,000; May 15: $116,000

B) May 10: $3,000; May 15: $30,000

C) May 10: $18,000; May 15: $86,000

D) May 10: $15,000; May 15: $56,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A corporation purchases 10,000 shares of its own $10 par common stock for $35 per share, recording it at cost. What will be the effect on total stockholders' equity?

A) increase by $100,000

B) increase by $350,000

C) decrease by $100,000

D) decrease by $350,000

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The entry to record the issuance of 150 shares of $5 par common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to

A) Organizational Expenses

B) Goodwill

C) Common Stock

D) Cash

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

The two main sources of stockholders' equity are investments contributed by stockholders and net income retained in the business.

B) False

Correct Answer

verified

Correct Answer

verified

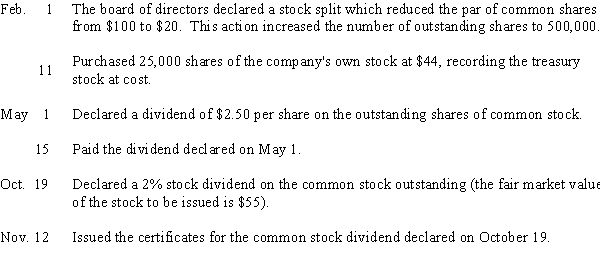

Essay

Prepare entries to record the following selected transactions completed during the current fiscal year:

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The state charter allows a corporation to issue only a certain number of shares of each class of stock. This amount of stock is called

A) treasury stock

B) issued stock

C) outstanding stock

D) authorized stock

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following stockholders' equity concepts to the most appropriate term (a-h). -The account used to record the difference when issue price exceeds par value of stock A)authorized shares B)issued shares C)outstanding shares D)par value E)common stock F)preferred stock G)Paid-In Capital in Excess of Par H)transfer agent

Correct Answer

verified

Correct Answer

verified

True/False

The main source of paid-in capital is from issuing stock.

B) False

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each of the following stockholders' equity concepts to the appropriate term (a-h). -The rules and procedures for conducting a corporation's affairs A)articles of incorporation B)limited liability C)bylaws D)corporation E)public corporation F)board of directors G)private corporation H)dividends

Correct Answer

verified

Correct Answer

verified

Essay

For the current year ended, ABC had the following transactions: - Issued 10,000 shares of $2.00 par value common stock for $12.00 per share.- Issued 3,000 shares of $50 par value 6% preferred stock for $70 per share.- Purchased 1,000 shares of previously issued common stock for $15.00 per share.- Reported net income of $200,000.- Declared and paid a total dividend of $40,000. Assume that retained earnings had a beginning balance of $75,000.The company does not have any stock outstanding as of the beginning of the current year. a.Treasury stock b.Retained earnings c.Preferred stock d.Excess of issue price over par (preferred)e.Common stock f.Total paid-in capital g.Excess of issue price over par (common)h.Total stockholders' equity -On April 1, 10,000 shares of $5 par common stock were issued at $22, and on April 7, 5,000 shares of $50 par preferred stock were issued at $104. Journalize the entries for April 1 and 7.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

All of the following are normally found in a corporation's stockholders' equity section except

A) Common Stock

B) Excess of Issue Price Over Par

C) Dividends in Arrears

D) Retained Earnings

F) None of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

For the current year ended, ABC had the following transactions: - Issued 10,000 shares of $2.00 par value common stock for $12.00 per share.- Issued 3,000 shares of $50 par value 6% preferred stock for $70 per share.- Purchased 1,000 shares of previously issued common stock for $15.00 per share.- Reported net income of $200,000.- Declared and paid a total dividend of $40,000. Assume that retained earnings had a beginning balance of $75,000.The company does not have any stock outstanding as of the beginning of the current year. a.Treasury stock b.Retained earnings c.Preferred stock d.Excess of issue price over par (preferred)e.Common stock f.Total paid-in capital g.Excess of issue price over par (common)h.Total stockholders' equity -$550,000

Correct Answer

verified

Correct Answer

verified

Essay

Sabas Company has 40,000 shares of $100 par, 1% preferred stock and 100,000 shares of $50 par common stock issued and outstanding. The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for each year.

Determine the dividends per share for preferred and common stock for each year.

Correct Answer

verified

Correct Answer

verified

Short Answer

Match the following stockholders' equity concepts to the appropriate term (a-h). -Equity account reflecting shares "owed" to stockholders A)cash dividend B)date of record C)Stock Dividends Distributable D)date of declaration E)treasury stock F)preferred stock G)date of payment H)Paid-In Capital in Excess of Par

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends:  Determine the dividends per share for preferred and common stock for the second year.

Determine the dividends per share for preferred and common stock for the second year.

A) $2.25 and $0.00

B) $2.25 and $0.45

C) $0.00 and $0.45

D) $2.00 and $0.45

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Under the Internal Revenue Code, corporations are required to pay federal income taxes.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The day on which the board of directors of the corporation distributes a dividend is called the declaration date.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The initial stockholders of a newly formed corporation are called directors.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Cash dividends become a liability to a corporation on the date of record.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 161 - 180 of 221

Related Exams