A) assets overstated by $70,000; retained earnings understated by $70,000; and net income statement understated by $70,000

B) assets overstated by $70,000; retained earnings understated by $70,000; and no effect on the income statement

C) assets, retained earnings, and net income all overstated by $70,000

D) assets and retained earnings overstated by $70,000; and net income understated by $70,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

For the year ended December 31, Depot Max's cost of goods sold was $56,900. Inventory at the beginning of the year was $6,540. Ending inventory was $7,250. Compute Depot Max's inventory turnover for the year.

A) 8.7

B) 7.8

C) 8.3

D) 44.0

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following units of an inventory item were available for sale during the year. Use this information to answer the following questions.Beginning inventory 10 units at $55 First purchase 25 units at $60 Second purchase 30 units at $65 Third purchase 15 units at $70 The firm uses the periodic inventory system. During the year, 60 units of the item were sold. -The ending inventory cost using FIFO is

A) $1,250

B) $1,350

C) $1,375

D) $1,150

F) All of the above

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description to the appropriate document used for inventory control (a-c). -last document in the chain, use to compare all three for accuracy A)Receiving report B)Vendor's invoice C)Purchase order

Correct Answer

verified

Correct Answer

verified

Essay

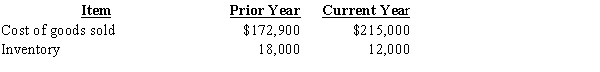

Based on the following information: compute (a) inventory turnover; (b) average daily cost of goods sold; and (c) number of days' sales in inventory for the current year. Use a 365-day year. (d) If an inventory turnover of 12 is average for the industry, how is this company doing?

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description to the appropriate cost flow assumption (a-c). -Widely used for tax purposes A)FIFO B)LIFO C)Weighted average

Correct Answer

verified

Correct Answer

verified

Essay

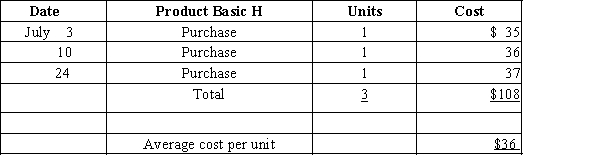

Three identical units of merchandise were purchased during July, as follows:  Assume one unit sells on July 28 for $45.Determine the gross profit, cost of goods sold, and ending inventory on July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) average cost flow methods.

Assume one unit sells on July 28 for $45.Determine the gross profit, cost of goods sold, and ending inventory on July 31 using (a) first-in, first-out, (b) last-in, first-out, and (c) average cost flow methods.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The following units of an inventory item were available for sale during the year. Use this information to answer the following questions.Beginning inventory 10 units at $55 First purchase 25 units at $60 Second purchase 30 units at $65 Third purchase 15 units at $70 The firm uses the periodic inventory system. During the year, 60 units of the item were sold. -The ending inventory cost using LIFO is

A) $1,250

B) $1,350

C) $1,375

D) $1,150

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Short Answer

Match each description to the appropriate cost flow assumption (a-d). -Cost flow matches the unit sold to the unit purchased. A)Weighted average B)First-in, first-out (FIFO)c.Last-in, first-out (LIFO)d.Specific identification

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cost flow is in the reverse order in which costs were incurred when using

A) weighted average

B) last-in, first-out

C) first-in, first-out

D) average cost

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If Beginning Inventory (BI) + Purchases (P) - Ending Inventory (EI) = Cost of Goods Sold (COGS) , an equivalent equation can be written as

A) BI + P = COGS - EI

B) BI - P = COGS + EI

C) BI + P = COGS + EI

D) EI + P = COGS - BI

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

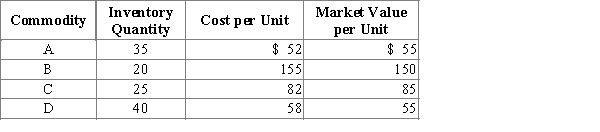

Basic inventory data for April 30 are presented below for a business that employs the lower-of-cost-or-market basis of inventory valuation to each category.  What is the amount of reduction in the inventory at April 30 attributable to market decline?

What is the amount of reduction in the inventory at April 30 attributable to market decline?

A) $14

B) $40

C) $180

D) $220

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The method of estimating inventory that uses records of the selling prices of the merchandise is called

A) retail method

B) gross profit method

C) inventory turnover method

D) average cost method

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

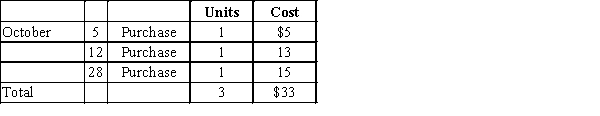

Assume that three identical units of merchandise were purchased during October, as follows:  -One unit is sold on October 31 for $28. Using the table provided, what is the cost of goods sold under the LIFO method?

-One unit is sold on October 31 for $28. Using the table provided, what is the cost of goods sold under the LIFO method?

A) $28

B) $18

C) $15

D) $13

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If inventory is being valued at cost and the purchase price is steadily falling, which method of costing will yield the largest net income?

A) average cost

B) LIFO

C) FIFO

D) weighted average

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Damaged merchandise that can be sold only at prices below cost should be valued at

A) net realizable value

B) LIFO

C) FIFO

D) average cost

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Short Answer

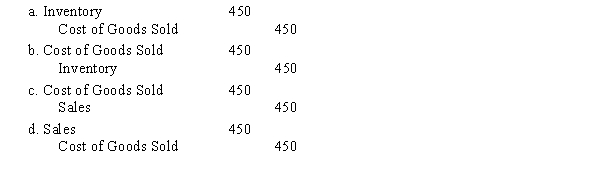

Addison, Inc. uses a perpetual inventory system. Below is information about one inventory item for the month of September.  -Use the information in the table to answer this question. If Addison uses FIFO, the September 17 entry for cost of goods sold would be:

-Use the information in the table to answer this question. If Addison uses FIFO, the September 17 entry for cost of goods sold would be:

Correct Answer

verified

Correct Answer

verified

Essay

Based on the following data, calculate the estimated cost of the inventory on March 31 using the retail method.

Correct Answer

verified

Correct Answer

verified

True/False

A subsidiary inventory ledger can be an aid in maintaining inventory levels at their proper levels.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

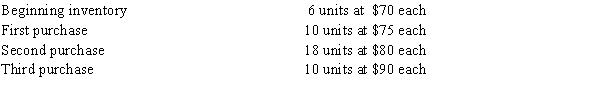

The beginning inventory and purchases of an item for the period were as follows:  The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost. Do not round your intermediate calculations. Round your final answer to two decimal places.

The company uses the periodic system, and there were 15 units in the inventory at the end of the period. Determine the cost of the 15 units in the inventory by each of the following methods, presenting details of your computations: (a) first-in, first-out; (b) last-in, first-out; (c) average cost. Do not round your intermediate calculations. Round your final answer to two decimal places.

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 236

Related Exams