Filters

Question type

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 72

True/False

If a firm busy on terms of 2/10 net 30, it should pay as early as possible during the discount period.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 73

True/False

Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 74

True/False

Funds from short-term loans can generally be obtained faster than from long-term loans for two reasons: (1) when lenders consider long-term loans they must make a more thorough evaluation of the borrower's financial health, and (2) long-term loan agreements are more complex.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 75

True/False

If a firm's suppliers stop offering discounts, then its use of trade credit is more likely to increase than to decrease, other things held constant.

A) True

B) False

B) False

Correct Answer

verified

Correct Answer

verified

Question 76

Multiple Choice

Which of the following items should a company report directly in its monthly cash budget?

A) Its monthly depreciation expense.

B) Cash proceeds from selling one of its divisions.

C) Accrued interest on zero coupon bonds that it issued.

D) New shares issued in a stock split.

E) New shares issued in a stock dividend.

F) C) and E)

G) D) and E)

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Question 77

Multiple Choice

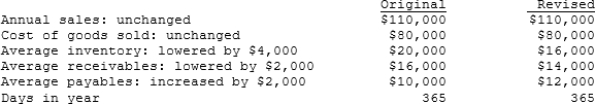

Zervos Inc. had the following data for 2008 (in millions) . The new CFO believes (1) that an improved inventory management system could lower the average inventory by $4,000, (2) that improvements in the credit department could reduce receivables by $2,000, and (3) that the purchasing department could negotiate better credit terms and thereby increase accounts payable by $2,000. Furthermore, she thinks that these changes would not affect either sales or the costs of goods sold. If these changes were made, by how many days would the cash conversion cycle be lowered?

A) 34.0

B) 37.4

C) 41.2

D) 45.3

E) 49.8

F) B) and E)

G) A) and D)

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Question 78

Multiple Choice

Madura Inc. wants to increase its free cash flow by $180 million during the coming year, which should result in a higher EVA and stock price. The CFO has made these projections for the upcoming year: EBIT is projected to equal $850 million. Gross capital expenditures are expected to total to $360 million versus depreciation of $120 million, so its net capital expenditures should total $240 million. The tax rate is 40%. There will be no changes in cash or marketable securities, nor will there be any changes in notes payable or accruals. What increase in net working capital (in millions of dollars) would enable the firm to meet its target increase in FCF?

A) $ 72

B) $ 90

C) $108

D) $130

E) $156

F) B) and E)

G) A) and B)

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 128 of 128

Related Exams