B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Economists blame the long lines at gasoline stations in the U.S.in the 1970s on

A) U.S.government regulations pertaining to the price of gasoline.

B) the Organization of Petroleum Exporting Countries (OPEC) .

C) major oil companies operating in the U.S.

D) consumers who bought gasoline frequently,even when their cars' gasoline tanks were nearly full.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the housing market,rent control causes

A) quantity supplied and quantity demanded to fall.

B) quantity supplied to fall and quantity demanded to rise.

C) quantity supplied to rise and quantity demanded to fall.

D) quantity supplied and quantity demanded to rise.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A payroll tax is a

A) fixed number of dollars that every firm must pay to the government for each worker that the firm hires.

B) tax that each firm must pay to the government before the firm can hire workers and operate its business.

C) tax on the wages that firms pay their workers.

D) tax on all wages above the minimum wage.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a price floor is not binding,then

A) there will be a surplus in the market.

B) there will be a shortage in the market.

C) there will be no effect on the market price or quantity sold.

D) the market will be less efficient than it would be without the price floor.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nonbinding price floor is imposed on a market,then

A) the quantity sold in the market will decrease.

B) the quantity sold in the market will stay the same.

C) the price in the market will increase.

D) the price in the market will decrease.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

A tax on buyers shifts the demand curve to the right.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price received by sellers in a market will increase if the government

A) decreases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) increases a tax on the good sold in that market.

D) imposes a binding price ceiling in that market.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In which of these cases will the tax burden fall most heavily on buyers of the good?

A) The demand curve is relatively steep and the supply curve is relatively flat.

B) The demand curve is relatively flat and the supply curve is relatively steep.

C) The demand curve and the supply curve are both relatively flat.

D) The demand curve and the supply curve are both relatively steep.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The price paid by buyers in a market will decrease if the government

A) increases a binding price floor in that market.

B) increases a binding price ceiling in that market.

C) decreases a tax on the good sold in that market.

D) More than one of the above is correct.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A surplus results when

A) a nonbinding price floor is imposed on a market.

B) a nonbinding price floor is removed from a market.

C) a binding price floor is imposed on a market.

D) a binding price floor is removed from a market.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

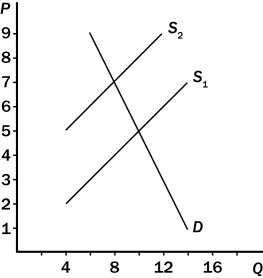

Figure 6-11  -Refer to Figure 6-11.Buyers pay how much of the tax per unit?

-Refer to Figure 6-11.Buyers pay how much of the tax per unit?

A) $1.

B) $1.50.

C) $2.50.

D) $3.50.

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

A price ceiling set below the equilibrium price causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A binding price ceiling causes a shortage in the market.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a nonbinding price ceiling is imposed on a market,then

A) the quantity sold in the market will decrease.

B) the quantity sold in the market will stay the same.

C) the price in the market will increase.

D) the price in the market will decrease.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The minimum wage was instituted to ensure workers

A) a middle-class standard of living.

B) employment.

C) a minimally adequate standard of living.

D) unemployment compensation.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If a tax is levied on the buyers of a product,then there will be a(n)

A) downward shift of the supply curve.

B) upward shift of the supply curve.

C) movement up and to the right along the supply curve.

D) movement down and to the left along the supply curve.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Whether a tax is levied on sellers or buyers,taxes encourage market activity.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Binding price floors benefit sellers because they allow sellers to sell all the goods they want at a higher price.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

A tax on sellers reduces the size of a market.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 181 - 200 of 459

Related Exams