A) $126,000

B) $46,000

C) $78,000

D) $22,000

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Financial measures such as ROI are generally better than nonfinancial measures of key success drivers such as customer satisfaction as leading indicators of future financial performance.

B) False

Correct Answer

verified

Correct Answer

verified

Essay

The Casket Division of Saal Corporation had average operating assets of $950,000 and net operating income of $135,200 in January.The company uses residual income to evaluate the performance of its divisions, with a minimum required rate of return of 13%. Required: What was the Casket Division's residual income in January?

Correct Answer

verified

Correct Answer

verified

Multiple Choice

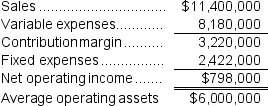

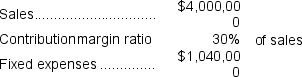

Beery Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $900,000 investment opportunity with the following characteristics:  The company's minimum required rate of return is 12%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

The company's minimum required rate of return is 12%.If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $848,700

B) $942,000

C) $24,300

D) $114,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

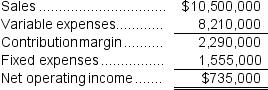

Worsell Inc.reported the following results from last year's operations:  The company's minimum required rate of return is 10%.Last year's residual income was closest to:

The company's minimum required rate of return is 10%.Last year's residual income was closest to:

A) $440,000

B) $490,000

C) ($638,000)

D) ($60,000)

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

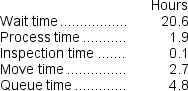

Simkin Corporation keeps careful track of the time required to fill orders.Data concerning a particular order appear below:  The manufacturing cycle efficiency (MCE) was closest to:

The manufacturing cycle efficiency (MCE) was closest to:

A) 0.46

B) 0.06

C) 0.20

D) 0.19

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The average operating assets for Year 2 were:

A) $1,000,000

B) $1,080,000

C) $1,200,000

D) $1,388,889

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

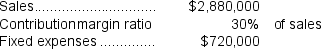

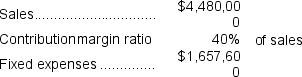

Braymiller Inc.has a $1,600,000 investment opportunity with the following characteristics:  The turnover for this investment opportunity is closest to:

The turnover for this investment opportunity is closest to:

A) 0.04

B) 0.40

C) 2.50

D) 25.00

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the company pursues the investment opportunity, this year's combined residual income for the entire company will be closest to:

A) $776,100

B) ($60,000)

C) $720,000

D) ($17,100)

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following measures of performance encourages continued expansion by an investment center so long as it is able to earn a return in excess of the minimum required return on average operating assets?

A) return on investment

B) transfer pricing

C) the contribution approach

D) residual income

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The throughput time was:

A) 4.6 hours

B) 9.7 hours

C) 20.6 hours

D) 16 hours

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

ROI and residual income are tools used to evaluate managerial performance in investment centers.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The division's margin is closest to:

A) 31.3%

B) 9.6%

C) 30.7%

D) 40.3%

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

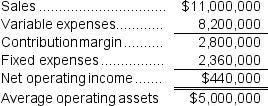

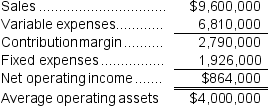

Anguiano Inc.reported the following results from last year's operations:  The company's average operating assets were $5,000,000.

Last year's return on investment (ROI) was closest to:

The company's average operating assets were $5,000,000.

Last year's return on investment (ROI) was closest to:

A) 7.0%

B) 14.7%

C) 45.8%

D) 47.6%

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Tennill Inc.has a $1,400,000 investment opportunity with the following characteristics:  The ROI for this year's investment opportunity considered alone is closest to:

The ROI for this year's investment opportunity considered alone is closest to:

A) 8.1%

B) 128.0%

C) 3.0%

D) 9.6%

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The delivery cycle time was:

A) 30.6 hours

B) 2 hours

C) 29.4 hours

D) 11.1 hours

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Cirone Inc.reported the following results from last year's operations:  At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,200,000 investment opportunity with the following characteristics:  If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year, the combined margin for the entire company will be closest to:

A) 3.1%

B) 8.4%

C) 6.3%

D) 12.1%

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

If a company contains a number of investment centers of differing sizes, return on investment (ROI)should be used rather than residual income to rank the financial performance of the divisions.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

An advantage of using ROI to evaluate performance is that it encourages the manager to reduce the investment in operating assets as well as increase net operating income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Return on investment (ROI)equals margin multiplied by sales.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 141 - 160 of 180

Related Exams