A) $69,600.

B) $81,200.

C) $72,000.

D) $84,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items typically found on the selling and administrative expense budget will also impact the cash budget?

A) Depreciation expense

B) Administrative salaries

C) Advertising expense

D) Both administrative salaries and advertising expense are correct.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

Janice was questioned recently about her department's spending in excess of the budget. This is an example of using the budget for performance measurement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The nature of planning changes with the length of the time period being considered. Generally, the shorter the time period, the more general the plans.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items would be least useful in preparing a schedule of cash receipts?

A) Expected revenue from cash sales.

B) Number of units expected to be purchased.

C) Service charges for credit card sales.

D) Past accounts receivable collection experience.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

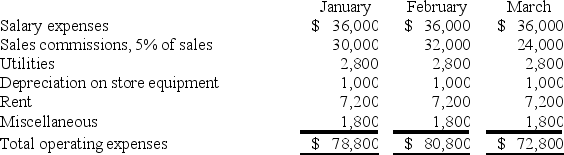

Barnes Company expects to begin operating on January 1. The company's master budget contained the following operating expense budget:  Sales commissions are paid in cash in the month following the month in which the expense is recognized. All other expense items requiring cash payment are paid in the month in which they are recognized. The amount of accumulated depreciation appearing on the company's March 31 pro forma balance sheet is:

Sales commissions are paid in cash in the month following the month in which the expense is recognized. All other expense items requiring cash payment are paid in the month in which they are recognized. The amount of accumulated depreciation appearing on the company's March 31 pro forma balance sheet is:

A) $1,000.

B) $2,000.

C) $3,000.

D) $12,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following items is not needed to prepare an inventory purchases budget for a merchandising business?

A) Expected unit selling price

B) Beginning inventory

C) Expected unit sales

D) Desired ending inventory

F) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

In a participative budgeting system, budget information flows in both directions, from bottom to top, and from top to bottom.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jason had been operating his machine for an entire month before he realized that it was generating more scrap than usual. Which advantage of budgeting would have helped him identify this problem sooner?

A) Performance measurement

B) Coordination

C) Planning

D) Corrective action

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The cash budget is not the same as the pro forma cash flow statement.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Although only 20 units are on hand at the beginning of the year, World Company plans to sell 100 units during Year 2. Assuming the company desires an ending inventory of 10 units, it should plan to purchase 110 units.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not considered a pro forma financial statement?

A) Sales budget

B) Balance sheet

C) Cash flow statement

D) Income statement

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not an advantage of budgeting?

A) Provides assurance that accounting records are in accordance with generally accepted accounting principles.

B) Forces coordination among departments to promote decisions in the best interests of the company as a whole.

C) Provides advance notice of potential shortages, bottlenecks, or other weaknesses in operating plans.

D) Provides a way to evaluate performance.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

If a budgeting system is designed correctly, top management will not have to get involved in the process.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following would be prepared first when a merchandising company uses a master budget?

A) Selling and administrative expense budget

B) Budgeted income statement

C) Sales forecast

D) Inventory purchases budget

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Select the correct equation format for the purchases budget.

A) Beginning inventory + expected sales = required purchases.

B) Cost of budgeted sales + beginning inventory - desired ending inventory = required purchases.

C) Beginning inventory + expected sales - desired ending inventory = required purchases.

D) Cost of budgeted sales + desired ending inventory - beginning inventory = required purchases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

The pro forma income statement gives managers an advance estimate of a company's profitability.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 101 - 117 of 117

Related Exams