A) $2,353.05

B) $2,466.45

C) $2,749.95

D) $2,835.00

E) $2,948.40

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You want to quit your job and go back to school for a law degree 4 years from now,and you plan to save $2,100 per year,beginning immediately.You will make 4 deposits in an account that pays 5.7% interest.Under these assumptions,how much will you have 4 years from today?

A) $10,633.92

B) $10,730.59

C) $8,700.48

D) $9,667.20

E) $8,507.13

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you borrowed $6,000 at a rate of 9.0% and must repay it in 4 equal installments at the end of each of the next 4 years.How large would your payments be?

A) $1,926.09

B) $1,852.01

C) $2,166.85

D) $1,833.49

E) $1,629.77

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

After graduation,you plan to work for Dynamo Corporation for 12 years and then start your own business.You expect to save and deposit $7,500 a year for the first 6 years (t = 1 through t = 6) and $15,000 annually for the following 6 years (t = 7 through t = 12) .The first deposit will be made a year from today.In addition,your grandfather just gave you a $37,500 graduation gift which you will deposit immediately (t = 0) .If the account earns 9% compounded annually,how much will you have when you start your business 12 years from now?

A) $372,417

B) $309,826

C) $312,955

D) $359,899

E) $334,862

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Starting to invest early for retirement increases the benefits of compound interest.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You are offered a chance to buy an asset for $5,250 that is expected to produce cash flows of $750 at the end of Year 1,$1,000 at the end of Year 2,$850 at the end of Year 3,and $6,250 at the end of Year 4.What rate of return would you earn if you bought this asset?

A) 15.56%

B) 16.75%

C) 18.61%

D) 16.91%

E) 13.36%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sam was injured in an accident,and the insurance company has offered him the choice of $45,000 per year for 15 years,with the first payment being made today,or a lump sum.If a fair return is 7.5%,how large must the lump sum be to leave him as well off financially as with the annuity?

A) $328,799.18

B) $333,069.30

C) $478,253.35

D) $324,529.06

E) $427,011.92

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You plan to invest in bonds that pay 6.0%,compounded annually.If you invest $10,000 today,how many years will it take for your investment to grow to $40,000?

A) 24.27

B) 28.31

C) 18.80

D) 23.79

E) 23.08

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If you have a series of cash flows,each of which is positive,you can solve for I,where the solution value of I causes the PV of the cash flows will be more than the cash flow at Time 0.

B) If you have a series of cash flows,and CF0 is negative but each of the following CFs is positive,you can solve for I,but only if the sum of the undiscounted cash flows exceeds the cost.

C) To solve for I,one must identify the value of I that causes the PV of the positive CFs to equal the absolute value of the FV of the negative CFs.It is impossible to find the value of I without a computer or financial calculator.

D) If you solve for I and get a negative number,then you must have made a mistake.

E) If CF0 is positive and all the other CFs are negative,then you can still solve for I.

G) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

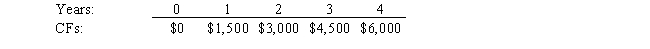

What is the present value of the following cash flow stream at a rate of 13.5%?

A) $8,275

B) $8,792

C) $8,895

D) $10,344

E) $10,964

G) B) and D)

Correct Answer

verified

Correct Answer

verified

True/False

As a result of compounding,the effective annual rate on a bank deposit (or a loan)is always equal to or greater than the nominal rate on the deposit (or loan).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose the U.S.Treasury offers to sell you a bond for $687.25.No payments will be made until the bond matures 5 years from now,at which time it will be redeemed for $1,000.What interest rate would you earn if you bought this bond at the offer price?

A) 8.80%

B) 6.93%

C) 6.70%

D) 7.48%

E) 7.79%

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Suppose Randy Jones plans to invest $1,000.He can earn an effective annual rate of 5% on Security A,while Security B has an effective annual rate of 12%.After 11 years,the compounded value of Security B should be somewhat less than twice the compounded value of Security A.(Ignore risk,and assume that compounding occurs annually. )

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you inherited $575,000 and invested it at 8.25% per year.How much could you withdraw at the end of each of the next 20 years?

A) $48,323.60

B) $59,658.76

C) $69,800.75

D) $61,448.53

E) $56,079.24

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Rocco Corporation's sales were $600 million.If sales grow at 6% per year,how large (in millions) will they be 5 years later?

A) $810.96

B) $722.64

C) $642.35

D) $979.58

E) $802.94

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Your uncle is about to retire,and he wants to buy an annuity that will provide him with $53,000 of income a year for 20 years,with the first payment coming immediately.The going rate on such annuities is 5.25%.How much would it cost him to buy the annuity today?

A) $558,149.79

B) $775,964.35

C) $680,670.48

D) $769,157.64

E) $714,704.01

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

What's the present value of $1,375 discounted back 5 years if the appropriate interest rate is 6%,compounded monthly?

A) $886.87

B) $1,019.39

C) $1,029.58

D) $958.22

E) $1,009.19

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

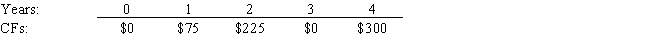

At a rate of 5.0%,what is the future value of the following cash flow stream?

A) $749

B) $679

C) $635

D) $514

E) $616

G) D) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Disregarding risk,if money has time value,it is impossible for the present value of a given sum to exceed its future value.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Suppose you have $2,000 and plan to purchase a 10-year certificate of deposit (CD) that pays 13.6% interest,compounded annually.How much will you have when the CD matures?

A) $7,945.78

B) $7,158.36

C) $6,156.19

D) $6,585.69

E) $5,440.35

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 164

Related Exams