A) 5.17

B) 5.33

C) 4.50

D) 6.36

E) 5.38

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In general,if investors believe that a company is relatively risky and/or has relatively poor growth prospects,then the company will have relatively high P/E,M/B,and EV/EBITDA ratios.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

You observe that a firm's ROE is above the industry average,but both its profit margin and equity multiplier are below the industry average.Which of the following statements is CORRECT?

A) Its total assets turnover must be above the industry average.

B) Its return on assets must equal the industry average.

C) Its TIE ratio must be below the industry average.

D) Its total assets turnover must be below the industry average.

E) Its total assets turnover must equal the industry average.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Last year Kruse Corp had $440,000 of assets (which is equal to its total invested capital) ,$403,000 of sales,$28,250 of net income,and a debt-to-total-capital ratio of 39%.The new CFO believes the firm has excessive fixed assets and inventory that could be sold,enabling it to reduce its total assets and total invested capital to $252,500.The firm finances using only debt and common equity.Sales,costs,and net income would not be affected,and the firm would maintain the same capital structure (but with less total debt) .By how much would the reduction in assets improve the ROE? Do not round your intermediate calculations.

A) 7.82%

B) 8.21%

C) 8.91%

D) 7.97%

E) 7.35%

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

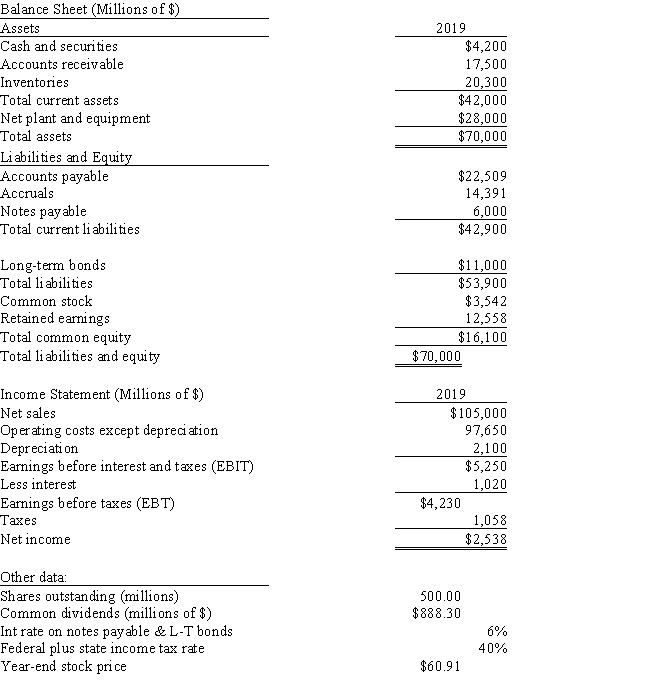

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's current ratio? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's current ratio? Do not round your intermediate calculations.

A) 1.04

B) 0.85

C) 0.80

D) 0.98

E) 1.10

G) A) and B)

Correct Answer

verified

Correct Answer

verified

True/False

It is appropriate to use the fixed assets turnover ratio to appraise firms' effectiveness in managing their fixed assets if and only if all of the firms being compared have the same proportion of fixed assets to total assets.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

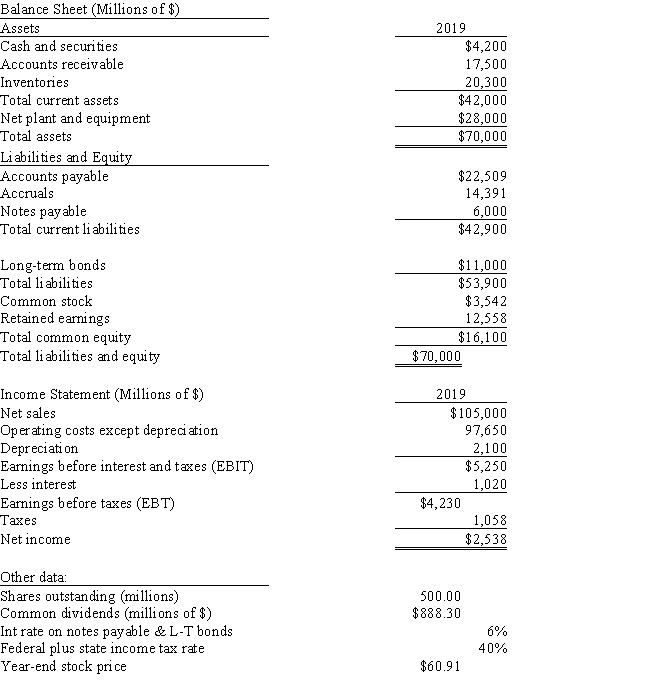

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's EPS? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's EPS? Do not round your intermediate calculations.

A) $6.29

B) $5.13

C) $5.08

D) $4.37

E) $6.24

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

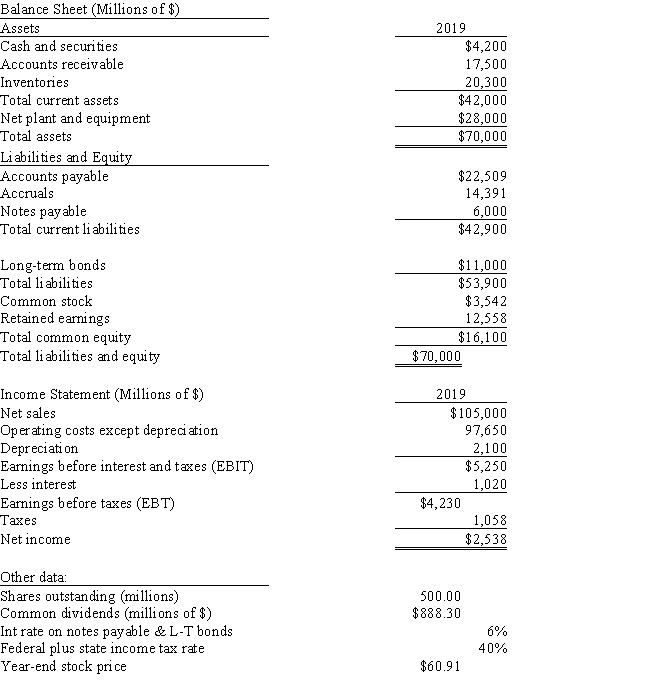

Exhibit 4.1

The balance sheet and income statement shown below are for Koski Inc.Note that the firm has no amortization charges,it does not lease any assets,none of its debt must be retired during the next 5 years,and the notes payable will be rolled over.

-Refer to Exhibit 4.1.What is the firm's TIE? Do not round your intermediate calculations.

-Refer to Exhibit 4.1.What is the firm's TIE? Do not round your intermediate calculations.

A) 4.58

B) 5.04

C) 6.28

D) 5.15

E) 3.91

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A new firm is developing its business plan.It will require $715,000 of assets (which equals total invested capital) ,and it projects $450,000 of sales and $355,000 of operating costs for the first year.Management is reasonably sure of these numbers because of contracts with its customers and suppliers.It can borrow at a rate of 7.5%,but the bank requires it to have a TIE of at least 4.0,and if the TIE falls below this level the bank will call in the loan and the firm will go bankrupt.The firm will use only debt and common equity for financing.What is the maximum debt to capital ratio (measured as debt/total invested capital) the firm can use? (Hint: Find the maximum dollars of interest,then the debt that produces that interest,and then the related debt to capital ratio. ) Do not round your intermediate calculations.

A) 39.86%

B) 51.38%

C) 44.29%

D) 34.10%

E) 38.53%

G) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In general,it's better to have a low inventory turnover ratio than a high one,as a low ratio indicates that the firm has an adequate stock of inventory relative to sales and thus will not lose sales as a result of running out of stock.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) The use of debt financing will tend to lower the basic earning power ratio,other things held constant.

B) A firm that employs financial leverage will have a higher equity multiplier than an otherwise identical firm that has no debt in its capital structure.

C) If two firms have identical sales,interest rates paid,operating costs,and assets,but differ in the way they are financed,the firm with less debt will generally have the higher expected ROE.

D) The numerator used in the TIE ratio is earnings before taxes (EBT) .EBT is used because interest is paid with post-tax dollars,so the firm's ability to pay current interest is affected by taxes.

E) Other things held constant,increasing the total debt to total capital ratio will increase the ROA.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

The price/earnings (P/E)ratio tells us how much investors are willing to pay for a dollar of current earnings.In general,investors regard companies with higher P/E ratios as less risky and/or more likely to enjoy higher growth in the future.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Other things held constant,the higher a firm's total debt to total capital ratio [measured as (Short-term debt + Long-term debt)/(Debt + Preferred stock + Common equity)],the higher its TIE ratio will be.

B) False

Correct Answer

verified

Correct Answer

verified

Showing 121 - 133 of 133

Related Exams